Question: Is there a platform that allows me to sync all my financial accounts and get a comprehensive view of my portfolio?

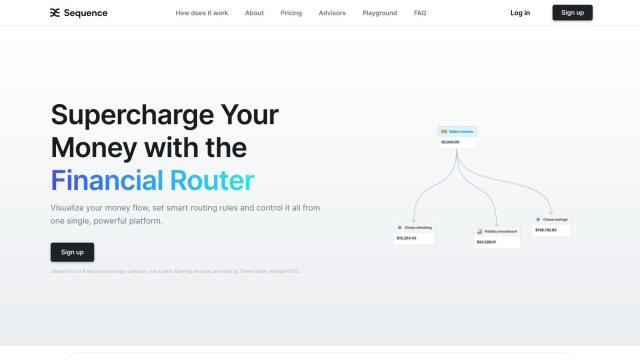

Sequence

If you're looking for a service to synchronize all your financial accounts and get a unified view of your financial situation, Sequence is a top contender. It aggregates multiple financial accounts, including checking and savings accounts, brokerage accounts, credit cards and cryptocurrency wallets. The dynamic UI money map gives you real-time visibility into your financial situation, and you can set up custom automations with smart rules to manage your finances better. Sequence has a range of pricing options and industry leading security, making it a powerful tool to take control of your financial life.

Canua

Another contender is Canua, which provides a unified view of your financial life by tracking accounts, investments and taxes. It automatically fetches and categorizes data to give you a unified view, and it has features like automatic FBAR report filing and connections to more than 17,000 banks and brokerages. Canua is geared for people with more complicated financial situations, but it's relatively affordable, and new customers who file their FBAR get a discount.

Pluto

If you want AI-powered investment advice, Pluto is a service worth a look. Pluto combines real-time market data with AI to help you make investment decisions. It provides portfolio optimization recommendations and integrates with all your financial accounts for a complete picture. Although it has a free tier, its Pro tier adds more features for $8 per month.

Envestnet | Yodlee

Last, Envestnet | Yodlee is a financial data aggregation service that connects to more than 17,000 data sources around the world. It gives you a detailed view of your financial life and powers a broad range of financial applications, including retail banking, credit and wealth management. The service is bank-level secure and can be easily integrated into existing infrastructure.