Question: Can you recommend a solution that helps with customer due diligence and vendor risk assessment for financial institutions?

LexisNexis Risk Solutions

If you're looking for a suite of tools to help with customer due diligence and vendor risk assessment for financial institutions, LexisNexis Risk Solutions has a range of tools. It combines advanced analytics, machine learning and AI with global identity intelligence to give a comprehensive view of customer and third-party risk. The platform includes tools such as Customer Identification Program, Customer Due Diligence, Watchlist Screening and Ongoing Monitoring to help financial institutions comply with anti-terrorism and money laundering regulations.

Prevalent

Another option is Prevalent, a third-party risk management platform that uses AI and automation to assess and mitigate security risks to organizations from vendors. It handles IT vendor risk management, supplier risk management and compliance, offering a centralized view of risk assessment and monitoring. The platform can help streamline risk management processes and offer contextual risk reporting and remediation, making it a good option for financial institutions.

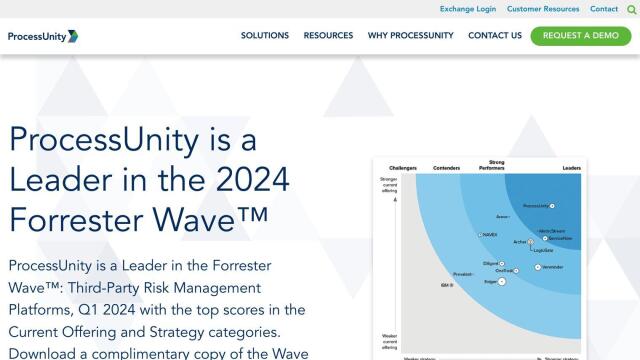

ProcessUnity

ProcessUnity is another option, with a single platform for third-party and cybersecurity risk management. It automates the entire risk lifecycle, from onboarding to continuous monitoring, with customizable workflow platforms and AI-powered tools. The platform handles vendor onboarding, assessments and monitoring, so it's a good option for a more comprehensive risk management program.

Whistic

If you're looking for a more streamlined vendor assessment process, check out Whistic. The platform automates vendor assessments and offers a centralized Trust Center for security and compliance documentation. With features like AI integration for task automation and insight generation, Whistic can help reduce the likelihood of a breach and make the sales process easier, too, so it's a good option for financial institutions.