Question: Can you recommend a platform that offers a custom portfolio monitoring system for cryptocurrency investors?

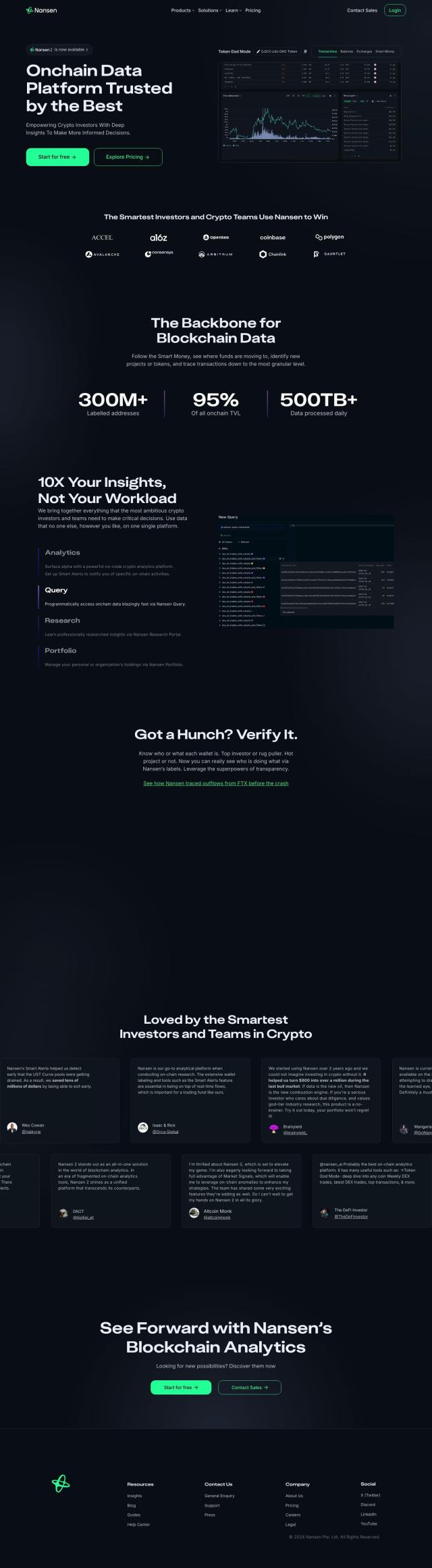

Nansen

If you're looking for a platform with a focus on portfolio monitoring for cryptocurrency investors, Nansen is a great option. It offers onchain data tracking, powerful no-code analytics and real-time dashboards to help you make decisions. Nansen also offers portfolio management and Smart Alerts, making it a great all-in-one tool for crypto investors. Pricing tiers include a free plan, a Pioneer Plan for $99/month, a Professional Plan for $999/month, and a customizable Enterprise Plan.

CryptoQuant

Another option is CryptoQuant, which offers a variety of on-chain and off-chain data, proprietary metrics and customizable analytics tools. With real-time alerts, pre-built charts and APIs, CryptoQuant is geared for trading and risk management. It also offers community-created custom metrics and indicators for deeper analysis. Pricing ranges from $29/month to $799/month, with institutional plans available.

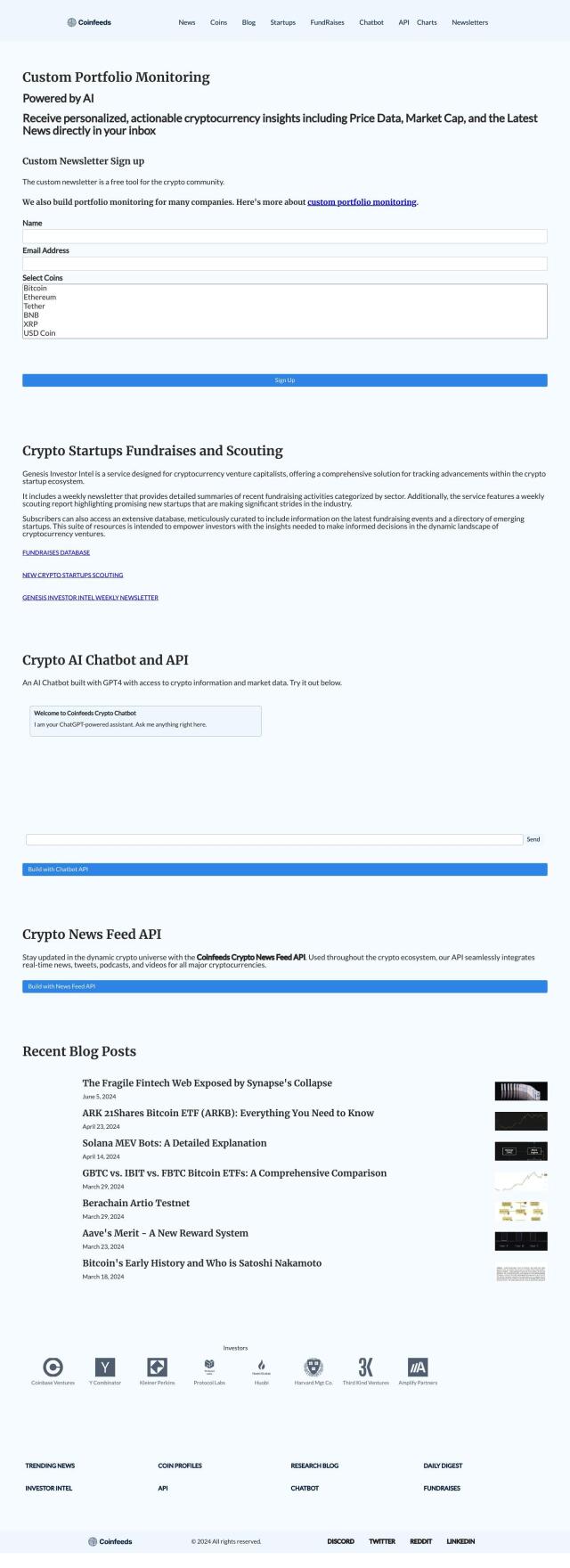

Coinfeeds

For those looking for data-driven insights and personalized portfolio monitoring, Coinfeeds is a good option. It offers real-time information on price data, market capitalization and news for the cryptocurrencies in your portfolio. Coinfeeds also offers Genesis Investor Intel for venture capitalists, a crypto AI chatbot for real-time information and a Crypto News Feed API for developers. The platform is geared to help users make better decisions with actionable insights.

One Click Crypto

Last, One Click Crypto is geared for DeFi portfolio management and rewards tracking. It uses AI to offer personalized portfolio recommendations and offers tools like an Airdrop Tracker and Farming Vaults for automatic rebalancing. This platform is good for yield farming and keeping up to date with DeFi market activity, with a variety of tools to help you optimize your portfolio.