Question: Do you know of a solution that provides backtesting and simulation for trading strategies to minimize risk?

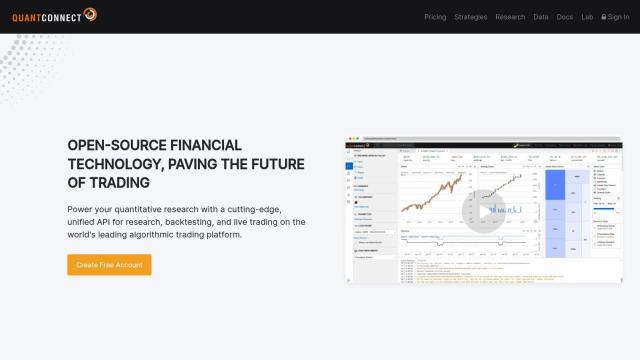

QuantConnect

For a powerful package that offers backtesting and simulation for trading strategies, QuantConnect is a top option. This platform for quants and engineers offers a collection of cloud-based tools for research, backtesting and live trading. It offers point-in-time backtesting, parameter optimization and deployment to co-located servers next to major exchanges. And you can tap into a library of alternative data and a strategy explorer to find and clone publicly shared strategies.

Tradetron

Another option is Tradetron, which lets you create, backtest and execute algo trading strategies without writing code. It offers a web-based strategy builder, backtesting engine and social trading, with reports to help you optimize your strategy. Tradetron supports a variety of broker APIs for easy integration with existing infrastructure, so it's a good option if you want to start trading algorithmically without a lot of hassle.

AlgoBulls

AlgoBulls is another option, particularly if you're not a programming whiz. It lets you create, execute and monitor sophisticated trading strategies, with support for multiple exchanges and brokers. The company offers features like generative AI that can turn your trading ideas into code, a library of tested and validated strategy code, and backtesting and paper trading tools, all through an interface that's designed to be easy to use.

Composer

If you like an AI-based approach, Composer lets you create and execute trading strategies with natural language instructions based on your goals and risk tolerance. It automates trading and rebalancing and offers prebuilt strategies you can customize. With support for integration with retirement accounts and real-time portfolio monitoring, Composer is a good option for automated trading.